IRS sending information letters to recipients of Advance Child Tax Credit Payments and third Economic Impact Payments The IRS started issuing information letters to Advance Child Tax Credit recipients in December. Recipients of the third round of the Economic Impact Payments will begin receiving information letters at the end of January. Using the information in… Read More

Half of the deferred Social Security tax payment is due on January 3, 2022. This is a final reminder to employers and self-employed individuals who chose to defer paying part of their 2020 Social Security tax obligation that a payment is due on Jan. 3, 2022. Most affected employers and self-employed individuals received reminder billing… Read More

Some Important Things You Should Do Before the Tax Year Ends December 31 is rapidly approaching. Here are some things you should do now to prepare for filing your 2021 taxes: Donate to Charity You may be able to deduct donations to tax-exempt organizations on your tax return. If you are still trying to decide… Read More

Individuals can contribute up to $20,500 in 2022. The amount individuals can contribute to their 401(k) plans in 2022 has increased to $20,500, up from $19,500 for 2021 and 2020. Highlights of Changes for 2022 The contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan… Read More

Tips for Deciding When to File an Amended Tax Return The October 15 extension to file your tax return has come and gone. Now, you realize you forgot to report something or claim a deduction. Should you file an amended return? Here are some tips to help you decide when to file an amended tax… Read More

A renewed tax credit can help employers hire workers; key certification requirements apply. With many businesses facing a tight job market, employers should check out a valuable tax credit available to them for hiring long-term unemployment recipients and other groups of workers facing significant barriers to employment. The Work Opportunity Tax Credit Legislation enacted in… Read More

Understanding IRAs: IRAs can provide financial security for your retirement. Individual Retirement Arrangements, or IRAs, provide tax incentives for you to make investments that can provide financial security for your retirement. These accounts can be set up with a bank or other financial institution, a life insurance company, mutual fund, or stockbroker. Types of Retirement… Read More

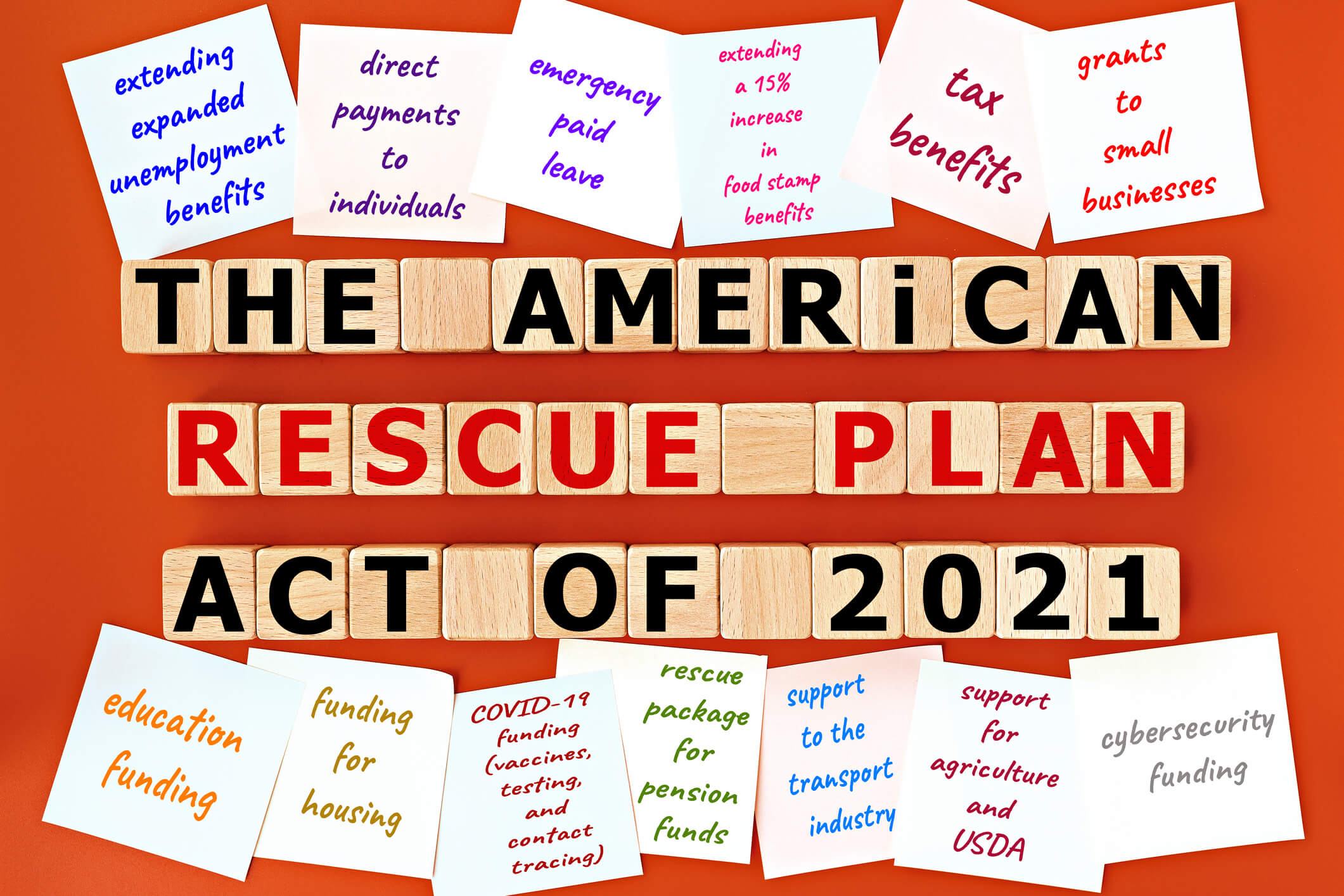

IRS continues unemployment compensation adjustments as it prepares another 1.5 million refunds. Another 1.5 million taxpayers will receive refunds averaging more than $1,600 as the IRS continues to adjust unemployment compensation from previously filed income tax returns. The American Rescue Plan Act of 2021, which became law in March, excluded up to $10,200 in 2020… Read More

Millions of American families have started receiving monthly Child Tax Credit payments. Millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes. This first batch of advance monthly payments worth roughly $15 billion reached about 35 million families across the… Read More

Homeownership and taxes: things taxpayers should consider when selling a house Right now, the housing market is as hot as it has been in years. Inventory is low and demand is high. In some areas, homeowners are receiving multiple offers at or above the asking price. Homes are also selling “as is” or “with no… Read More