Tax Withholding: How To Get It Right

Understanding Tax Withholding

The federal income tax is a pay-as-you-go tax. Taxpayers pay the tax as they earn or receive income during the year. You can avoid a surprise at tax time by checking your withholding amount. You should perform a Paycheck Checkup early in 2019, even if you did one in 2018. This includes anyone who receives a pension or annuity. Here’s what to know about withholding and why checking it is important.

The federal income tax is a pay-as-you-go tax. Taxpayers pay the tax as they earn or receive income during the year. You can avoid a surprise at tax time by checking your withholding amount. You should perform a Paycheck Checkup early in 2019, even if you did one in 2018. This includes anyone who receives a pension or annuity. Here’s what to know about withholding and why checking it is important.

An employer generally withholds income tax from your paycheck and pays it to the IRS on your behalf. Wages paid, along with any amounts withheld, are reflected on the Form W-2, Wage and Tax Statement, you receive at the end of the year.

How Withholding is Determined

The amount withheld depends on:

- The amount of income earned

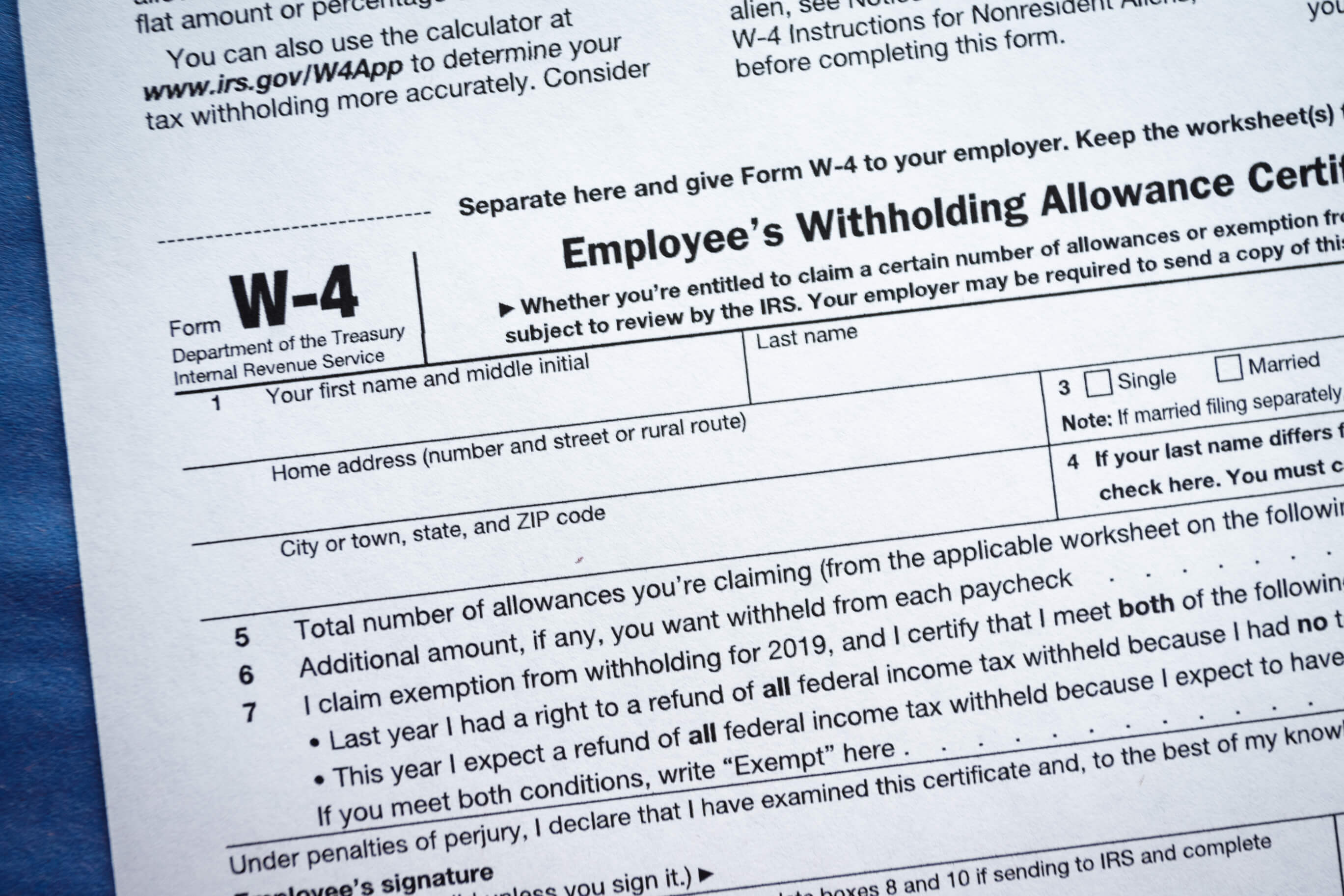

- Three types of information you give your employer on Form W–4, Employee’s Withholding Allowance Certificate:

- Filing status: Either the single rate or the lower married rate.

- Number of withholding allowances claimed: Each allowance claimed reduces the amount withheld.

- Additional withholding: You can request an additional amount to be withheld from each paycheck.

Note: You must specify a filing status and your number of withholding allowances on Form W–4. You cannot specify only a dollar amount of withholding.

Everyone Should Check Withholding

Everyone should do a Paycheck Checkup early in 2019. Though especially important for anyone with a 2018 tax bill, it’s also important for anyone whose refund is larger or smaller than expected. By changing withholding now, you can get the refund you want next year. For those who owe, boosting tax withholding early in 2019 is the best way to head off a tax bill a year from now. In addition, you should always check your withholding when a major life event occurs or when your income changes.

When to Check Withholding:

- Early in the year

- If the tax law changes

- When life changes occur:

- Lifestyle – Marriage, divorce, birth or adoption of a child, home purchase, retirement, filing chapter 11 bankruptcy

- Wage income – You or your spouse starts or stops working or starts or stops a second job

- Taxable income not subject to withholding – Interest, dividends, capital gains, self-employment and gig economy income, and IRA (including certain Roth IRA) distributions

- Itemized deductions or tax credits – Medical expenses, taxes, interest expense, gifts to charity, dependent care expenses, education credit, Child Tax Credit, Earned Income Tax Credit

How to Check Withholding

- The Withholding Calculator on IRS.gov can help you to determine whether you need to give your employer a new Form W-4. You can use the results from the calculator to help fill out the form and adjust your income tax withholding. If you receive pension income, you can use the results from the calculator to complete a Form W-4P, Withholding Certificate for Pension and Annuity Payments, and give it to your payer.

- If you have more complex situations, you may need to use Publication 505 instead of the Withholding Calculator. This includes employees who owe self-employment tax, the alternative minimum tax, or tax on unearned income from dependents. It can also help those who receive non-wage income such as dividends, capital gains, rents, and royalties. The publication includes worksheets and examples to guide you through these special situations.

Change Withholding

To change your tax withholding, you can use the results from the Withholding Calculator to determine if you should complete a new Form W-4 and submit it to your employer. Don’t file it with the IRS.

If you don’t pay taxes through withholding or you don’t pay enough tax that way, you may still use the Withholding Calculator to determine if you have to pay estimated tax quarterly during the year to the IRS. Those who are self-employed generally pay tax this way. See Form 1040-ES, Estimated Taxes for Individuals, for details.

As always, feel free to contact your local tax professional if you still have questions about your withholding.

Bayshore CPA’s, P.A. are your local Certified Public Accountants

and Tax Resolution Specialists conveniently located

in Mooresville, North Carolina

Photo 138119844 © Ricky Kresslein – Dreamstime.com