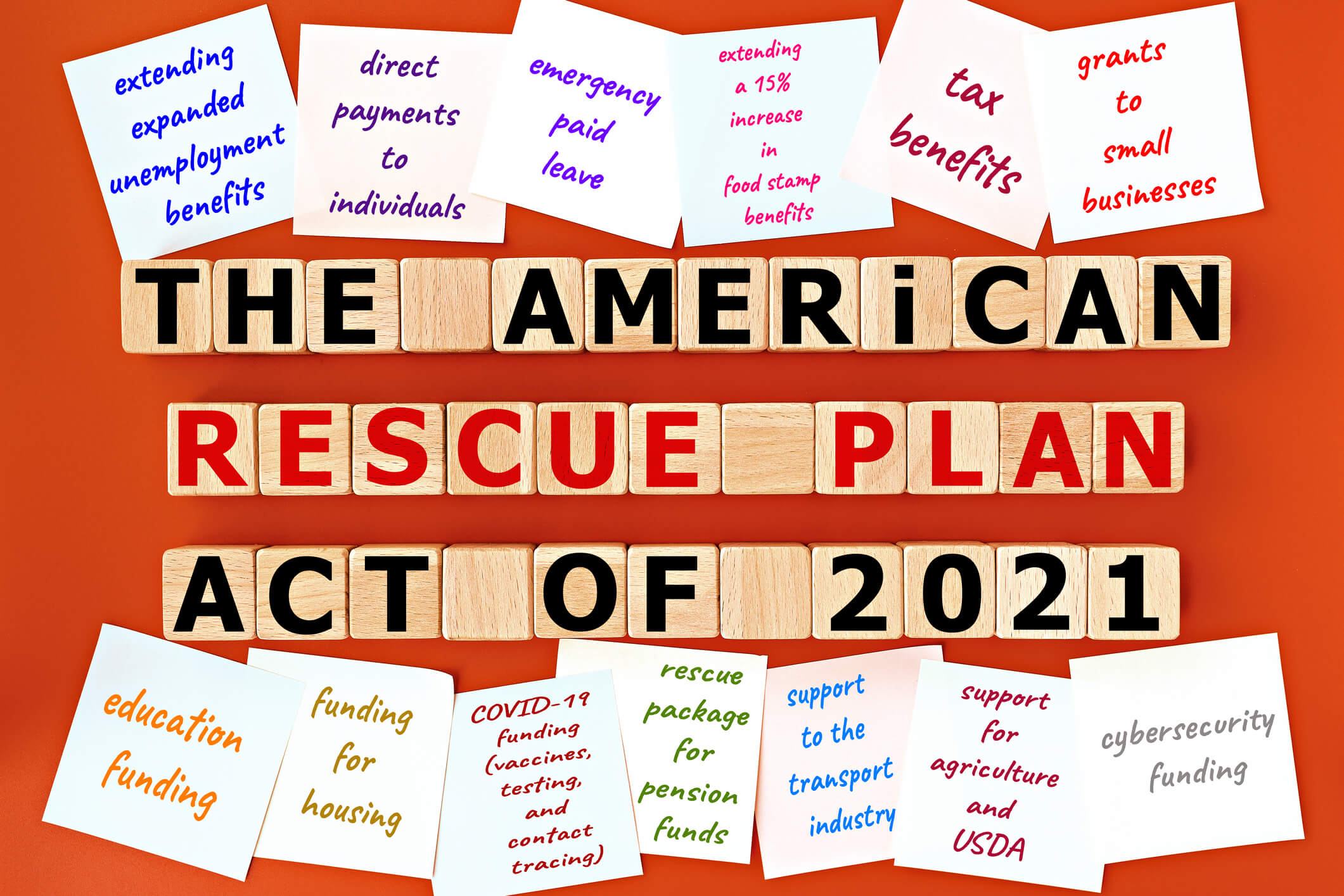

The American Rescue Plan and Your 2021 Taxes

Looking ahead: How the American Rescue Plan affects 2021 taxes

Part 1

The 2020 tax filing deadline may have just passed, but it is never too early to start planning for filing your 2021 taxes. This post is the first of two that provide an overview of how the American Rescue Plan may affect some individual’s 2021 taxes.

The 2020 tax filing deadline may have just passed, but it is never too early to start planning for filing your 2021 taxes. This post is the first of two that provide an overview of how the American Rescue Plan may affect some individual’s 2021 taxes.

Child and Dependent Care Credit Increased for 2021 Only

The new law increases the amount of the credit and the percentage of employment-related expenses for qualifying care considered in calculating the credit. It modifies the phase-out of the credit for higher earners and makes it refundable for eligible taxpayers.

For 2021, eligible taxpayers can claim qualifying employment-related expenses up to:

- $8,000 for one qualifying individual, up from $3,000 in prior years, or

- $16,000 for two or more qualifying individuals, up from $6,000.

The maximum credit in 2021 increased to 50% of the taxpayer’s employment-related expenses, which equals $4,000 for one qualifying individual or $8,000 for two or more qualifying individuals. When figuring the credit, subtract employer-provided dependent care benefits, such as those provided through a flexible spending account, from the total employment-related expenses.

A qualifying individual is a dependent under the age of 13 or a dependent or spouse of any age who is incapable of self-care and who lives with the taxpayer for more than half of the year.

As before, the more you earn, the lower the percentage of employment-related expenses that are considered in determining the credit. However, under the new law, more individuals will qualify for the new maximum 50% of employment-related expenses credit percentage rate. That’s because the adjusted gross income level at which the credit percentage starts to phase out is raised to $125,000. Above $125,000, the 50% credit percentage goes down as income rises. It is entirely unavailable for any taxpayer with an adjusted gross income over $438,000.

The credit is fully refundable for the first time in 2021. This means an eligible taxpayer can receive it even if they owe no federal income tax. To be eligible for the refundable portion of the credit, a taxpayer, or the taxpayer’s spouse if filing a joint return, must reside in the United States for at least half of the year.

Workers Can Set Aside More in a Dependent Care FSA

For 2021, the maximum amount of tax-free employer-provided dependent care benefits increased to $10,500. This means an employee can set aside $10,500 in a dependent care flexible spending account instead of the normal $5,000.

Workers can only do this if their employer adopts this change. Employees should contact their employer for details.

Childless EITC Expanded for 2021

For 2021 only, more workers without qualifying children can qualify for the earned income tax credit, a fully refundable tax benefit that helps many low- and moderate-income workers and working families. The maximum credit is nearly tripled for these taxpayers and is, for the first time, available to younger workers. Now, it also has no age limit cap.

For 2021, EITC is generally available to filers without qualifying children who are at least 19 years old with earned income below $21,430 and $27,380 for spouses filing a joint return. The maximum EITC for filers with no qualifying children is $1,502.

Another change for 2021 allows individuals to figure the EITC using their 2019 earned income if it was higher than their 2021 earned income. In some instances, this option will give them a larger credit.

A Final Note

Contact your tax professional for more detailed information regarding your particular tax situation, and stay tuned for Part 2.

For the most recent copy of our newsletter or to subscribe, check out the Resources page on our website.

Stay safe. Stay well.

Bayshore CPA’s, P.A. are your local Certified Public Accountants

and Tax Resolution Specialists conveniently located

in Mooresville, North Carolina

Image: Photo 216810616 / American Rescue Plan © 777ers | Dreamstime.com