More Unemployment-Related Refunds on the Way

IRS continues unemployment compensation adjustments as it prepares another 1.5 million refunds.

Another 1.5 million taxpayers will receive refunds averaging more than $1,600 as the IRS continues to adjust unemployment compensation from previously filed income tax returns.

Another 1.5 million taxpayers will receive refunds averaging more than $1,600 as the IRS continues to adjust unemployment compensation from previously filed income tax returns.

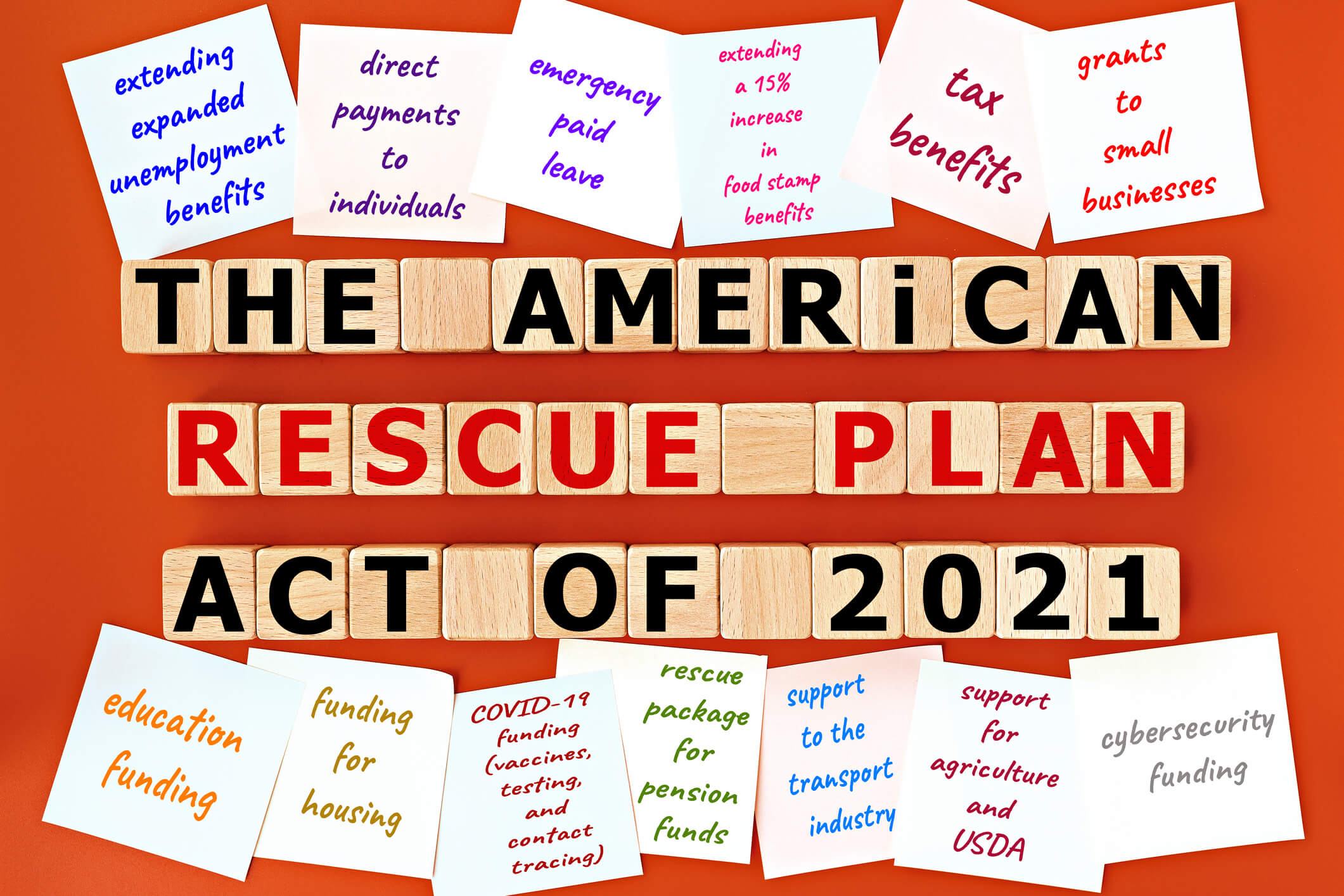

The American Rescue Plan Act of 2021, which became law in March, excluded up to $10,200 in 2020 unemployment compensation from taxable income calculations. The exclusion applied to individuals and married couples whose modified adjusted gross income was less than $150,000.

How Refunds Are Issued

Refunds by direct deposit began July 28 and refunds by paper check will begin July 30. This is the fourth round of refunds related to the unemployment compensation exclusion provision.

Since May, over 8.7 million unemployment compensation refunds totaling over $10 billion have been issued. The IRS will continue reviewing and adjusting tax returns in this category this summer.

How Refunds Are Determined

These efforts focused on minimizing the burden on taxpayers so that most people will not have to take any additional action to receive the refund. IRS employees review and adjust returns for these taxpayers. For taxpayers who overpaid, the IRS will either refund the overpayment or apply it to other outstanding taxes or other federal or state debts owed.

For this round, the IRS identified approximately 1.7 million taxpayers who were due an adjustment. Of that number, approximately 1.5 million taxpayers are expected to receive a refund. The refund average is $1,686.

The IRS started with the simplest tax returns and is now reviewing more complex returns. The average refund amount is higher for this round because the IRS included an adjustment to the Advance Premium Tax Credit (APTC).

Action You May Need to Take

Most taxpayers need not take any action and there is no need to call the IRS. However, because of the excluded unemployment compensation, if you are now eligible for deductions or credits not claimed on your original return, you should file a Form 1040-X, Amended U.S. Individual Income Tax Return.

You should file an amended return if:

- You did not submit a Schedule 8812 with your original return to claim the Additional Child Tax Credit and are now eligible for the credit after the unemployment compensation exclusion.

- You did not submit a Schedule EIC with your original return to claim the Earned Income Tax Credit (with qualifying dependents) and are now eligible for the credit after the unemployment compensation exclusion.

- You are now eligible for any other credits and/or deductions not mentioned below. Make sure to include any required forms or schedules.

You do not need to file an amended return if:

- You already filed a tax return and did not claim the unemployment exclusion.

- The IRS will determine the correct taxable amount of unemployment compensation and tax.

- You have an adjustment, because of the exclusion, that will result in an increase in any non-refundable or refundable credits reported on your original return.

- You did not claim the following credits on your tax return but are now eligible when the unemployment exclusion is applied:

- Recovery Rebate Credit

- Earned Income Credit with no qualifying dependents

- Advance Premium Tax Credit. The IRS will calculate the credit and include it in any overpayment.

- You filed a married filing joint return, live in a community property state, and entered a smaller exclusion amount than entitled on Schedule 1, line 8.

You will generally receive a letter from the IRS within 30 days of the adjustment informing you what kind of adjustment was made (such as refund, payment of IRS debt payment, or payment offset for other authorized debts), and the amount of the adjustment.

A Final Note

If you have questions concerning your eligibility for unemployment compensation adjustments, you may contact a tax professional.

For the most recent copy of our newsletter or to subscribe, check out the Resources page on our website.

Stay safe. Stay well.

Bayshore CPA’s, P.A. are your local Certified Public Accountants

and Tax Resolution Specialists conveniently located

in Mooresville, North Carolina

Image: Photo 216810616 / American Rescue Plan © 777ers | Dreamstime.com