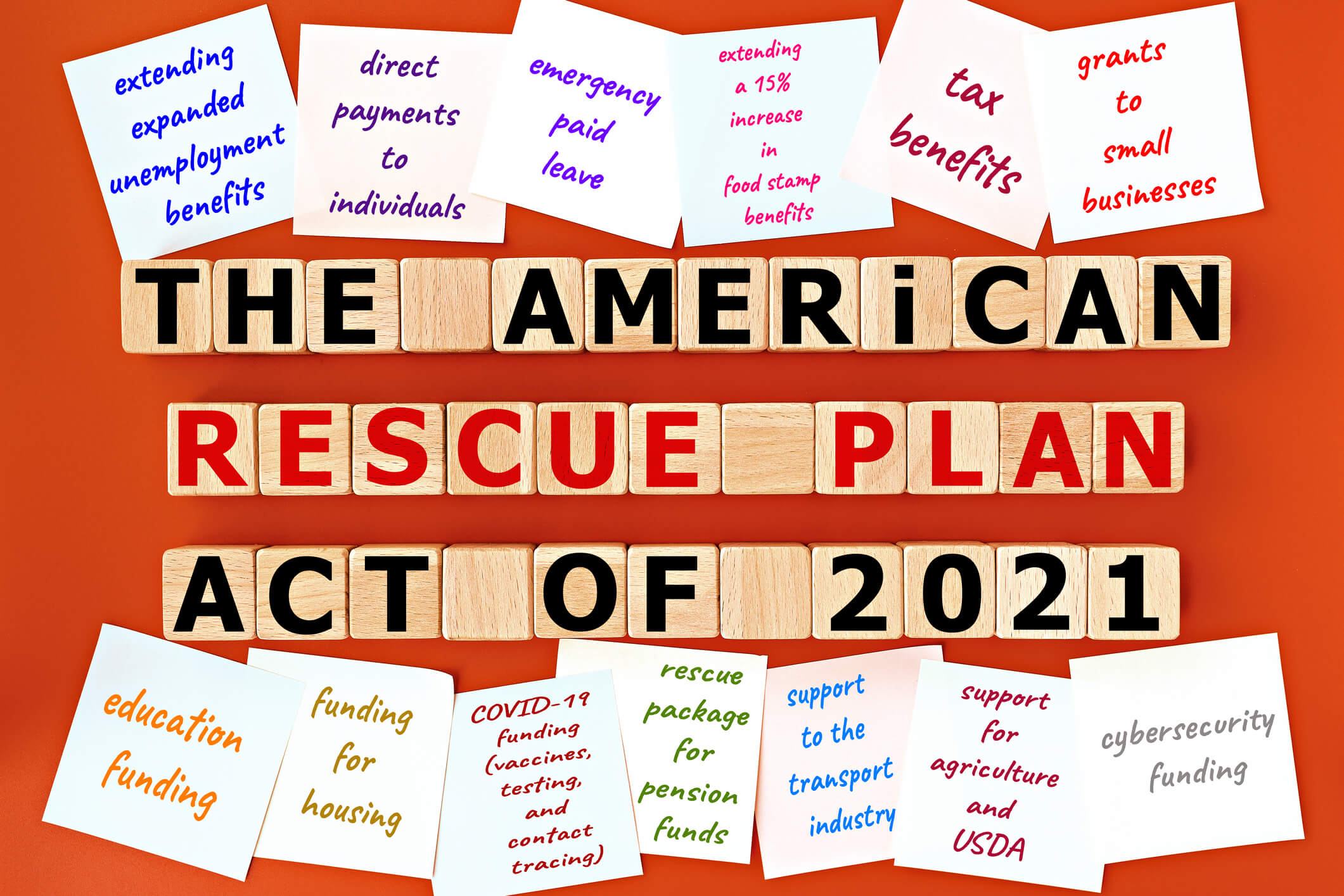

Part 2: American Rescue Plan and 2021 Taxes

Looking ahead: How the American Rescue Plan affects 2021 taxes.

This post is the second of a two-part overview of ways the American Rescue Plan may affect your 2021 taxes. You can read Part 1 on the Blog page of our website.

This post is the second of a two-part overview of ways the American Rescue Plan may affect your 2021 taxes. You can read Part 1 on the Blog page of our website.

Changes Expanding EITC for 2021 and Beyond

New law changes expand the Earned Income Tax Credit (EITC) for 2021 and future years. These changes include:

- More workers and working families who also have investment income can get the credit. Starting in 2021, the amount of investment income they can receive and still be eligible for the EITC increases to $10,000.

- Married but separated spouses who do not file a joint return may qualify to claim the EITC. They qualify if they live with their qualifying child for more than half the year and either:

-

- Do not have the same principal place of residence as the other spouse for at least the last six months of the tax year for which the EITC is being claimed, or

- Are legally separated according to their state law under a written separation agreement or a decree of separate maintenance and do not live in the same household as their spouse at the end of the tax year for which the EITC is being claimed.

Expanded Child Tax Credit for 2021 Only

The American Rescue Plan made several notable but temporary changes to the child tax credit, including:

- Increasing the amount of the credit

- Making it available for qualifying children who turn age 17 in 2021

- Making it fully refundable for most taxpayers

- Allowing many taxpayers to receive half of the estimated 2021 credit in advance

Taxpayers who have qualifying children under age 18 at the end of 2021 can now get the full credit if they have little or no income from a job, business, or other source. Prior to 2021, the credit was worth up to $2,000 per qualifying child, with the refundable portion limited to $1,400 per child. The new law increases the credit to as much as $3,000 per child ages 6 through 17 at the end of 2021, and $3,600 per child ages 5 and under at the end of 2021. For taxpayers who have their primary homes in the United States for more than half of the tax year, the credit is fully refundable, and the $1,400 limit does not apply. This includes bona fide residents of Puerto Rico.

The maximum credit is available to taxpayers with a modified adjusted gross income of:

- $75,000 or less for single filers and married persons filing separate returns

- $112,500 or less for heads of household

- $150,000 or less for married couples filing a joint return and qualifying widows and widowers

Above these income thresholds, the excess amount over the original $2,000 credit — either $1,000 or $1,600 per child — reduces by $50 for every $1,000 in additional modified Adjusted Gross Income (AGI). The original $2,000 credit continues to be reduced by $50 for every $1,000 that modified AGI is more than $200,000; $400,000 for married couples filing a joint return.

Advance Child Tax Credit Payments

From July 15 through December 2021, Treasury and the IRS will advance one half of the estimated 2021 child tax credit in monthly payments to eligible taxpayers. You are an eligible taxpayer if you have a main home in the United States for more than half the year. This means the 50 states and the District of Columbia. U.S. military personnel stationed outside the United States on extended active duty are considered to have a main home in the United States.

The monthly advance payments will be estimated from the taxpayer’s 2020 tax return or the 2019 tax return if 2020 information is not available. Advance payments will not be reduced or offset for overdue taxes or other federal or state debts owed by the taxpayer or their spouse. The remaining child tax credit will be based on the taxpayer’s 2021 information and claimed on the 2021 income tax return.

A Final Note

Contact your tax professional for more detailed information on how the American Rescue Plan may affect your 2021 taxes.

For the most recent copy of our newsletter or to subscribe, check out the Resources page on our website.

Stay safe. Stay well.

Bayshore CPA’s, P.A. are your local Certified Public Accountants

and Tax Resolution Specialists conveniently located

in Mooresville, North Carolina

Image: Photo 216810616 / American Rescue Plan © 777ers | Dreamstime.com