Results On Your 2018 Tax Return Not What You Expected? Now Is The Time To Make Adjustments.

A few weeks ago, we wrote about understanding tax withholding and how to get it right. Many taxpayers were surprised by the results—not necessarily in a good way–when filing their 2018 returns. Many owed more taxes than anticipated and others’ refunds were less than expected. Much of this was due to the amount the employer withheld based on the information on the employee’s W-4.

A few weeks ago, we wrote about understanding tax withholding and how to get it right. Many taxpayers were surprised by the results—not necessarily in a good way–when filing their 2018 returns. Many owed more taxes than anticipated and others’ refunds were less than expected. Much of this was due to the amount the employer withheld based on the information on the employee’s W-4.

Millions of taxpayers filed a 2018 tax return in the last few weeks, making now a prime time for everyone to consider whether their tax situation came out as they expected. If yours did not, you can use your recently finished 2018 return and the IRS Withholding Calculator to do a Paycheck Checkup and adjust your withholding.

Checking and then adjusting your tax withholding can help make sure you don’t owe more tax than you are expecting. This could help you avoid a surprise tax bill and possibly a penalty when you file your 2019 return.

The Average Refund Is More Than $2,700

At the same time, with the average refund more than $2,700, some taxpayers may choose to reduce their withholding to have a larger paycheck and smaller refund.

Now is an ideal time to check withholding, since having a completed tax return is helpful when using the Withholding Calculator on IRS.gov. Since you need to estimate deductions, credits, and other amounts for 2019, having similar information from the 2018 return can make using the Withholding Calculator easier.

Who Should Do A Paycheck Checkup?

Though doing a Paycheck Checkup is a good idea every year, for many people it’s even more important this year. This includes anyone who:

- Adjusted their withholding in 2018 – especially those who did so in the middle or later part of the year.

- Owed additional tax when they filed their tax return this year.

- Had a refund that was larger or smaller than expected.

- Had life changes such as marriage, childbirth, adoption, buying a home, or changes in income.

In addition, most people are affected by changes made in the Tax Cuts and Jobs Act (TCJA), the tax reform legislation enacted in December 2017. These changes included lowered tax rates, increased standard deductions, suspension of personal exemptions, the increased Child Tax Credit, and limited or discontinued deductions. This is why it is a good idea to check your withholding, even if you did a Paycheck Checkup in 2018.

This includes taxpayers who:

- Have children and claim credits, such as the Child Tax Credit.

- Have older dependents, including children age 17 or older.

- Itemized deductions in the past.

- Are a two-income family.

- Have two or more jobs at the same time.

- Only work part of the year.

- Have high income or a complex tax return.

Those with more complex situations may need to refer to Publication 505, Tax Withholding and Estimated Tax, instead of the Withholding Calculator. This includes employees who owe self-employment tax, the alternative minimum tax, or tax on unearned income from dependents. It can also help those who receive non-wage income, such as dividends, capital gains, rents, and royalties.

Sooner Is Better For A Paycheck Checkup

We urge you to do a Paycheck Checkup as early in the year as possible. By doing so, if a tax withholding adjustment is needed, there is more time for withholding to happen evenly during the rest of the year. Waiting means there are fewer pay periods to withhold the necessary federal tax.

Changing Withholding

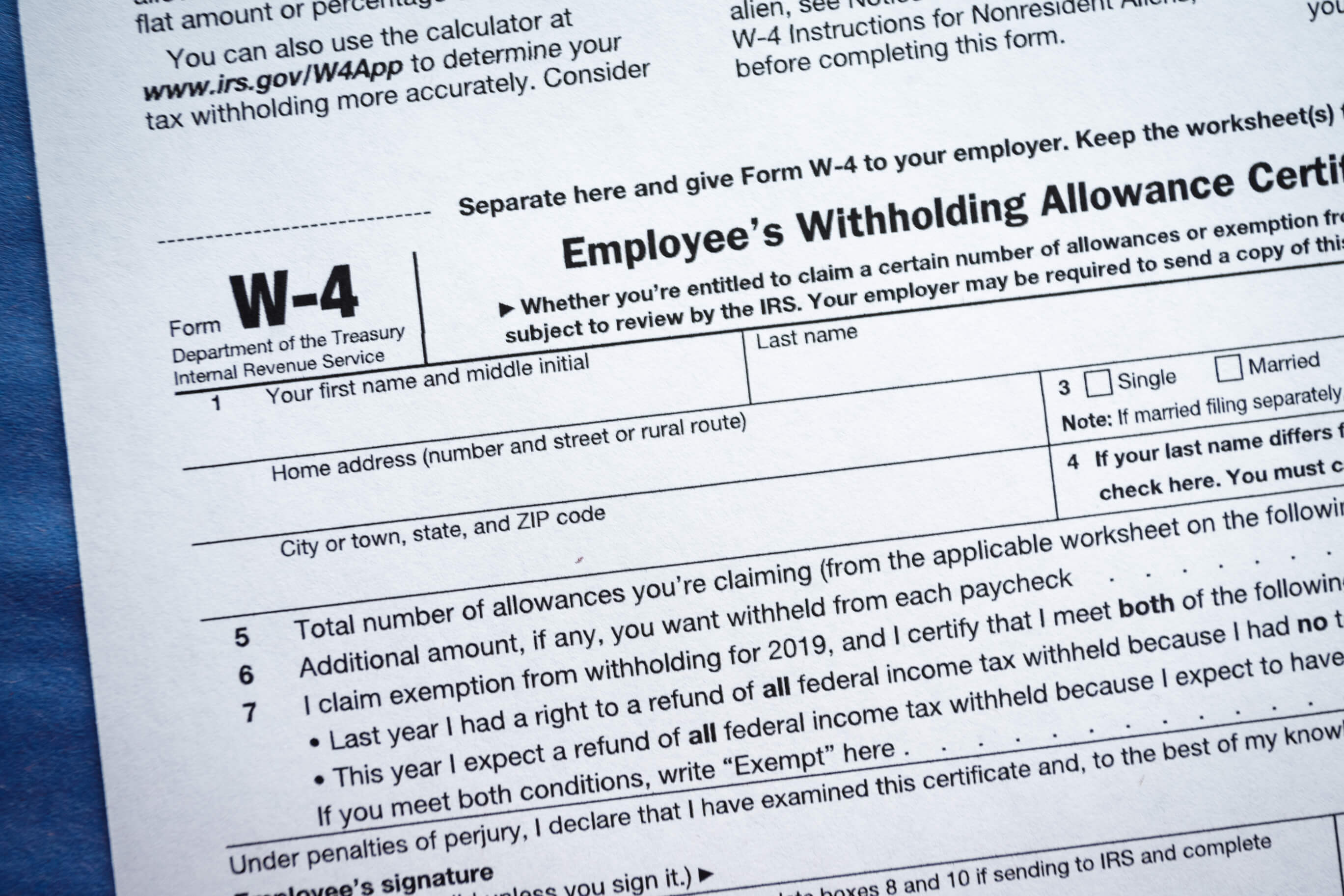

Employees can use the results from the Withholding Calculator to see if they need to complete a new Form W-4, Employee’s Withholding Allowance Certificate, and submit it to their employer. In some instances, the calculator may recommend that the employee have an additional flat-dollar amount withheld each pay period. Taxpayers do not need to send this form to the IRS after giving it to their employer.

Those who don’t pay taxes through withholding, or pay too little tax that way, may still use the Withholding Calculator to determine if they need to pay estimated tax to the IRS quarterly during the year. Those who are self-employed generally pay tax this way. See Form 1040-ES, Estimated Taxes for Individuals, for details.

Need Help?

As always, check with your tax professional if you need additional information about your withholding allowance.

Bayshore CPA’s, P.A. are your local Certified Public Accountants

and Tax Resolution Specialists conveniently located

in Mooresville, North Carolina

Photo 138119844 © Ricky Kresslein – Dreamstime.com