Homeownership and taxes: things taxpayers should consider when selling a house Right now, the housing market is as hot as it has been in years. Inventory is low and demand is high. In some areas, homeowners are receiving multiple offers at or above the asking price. Homes are also selling “as is” or “with no… Read More

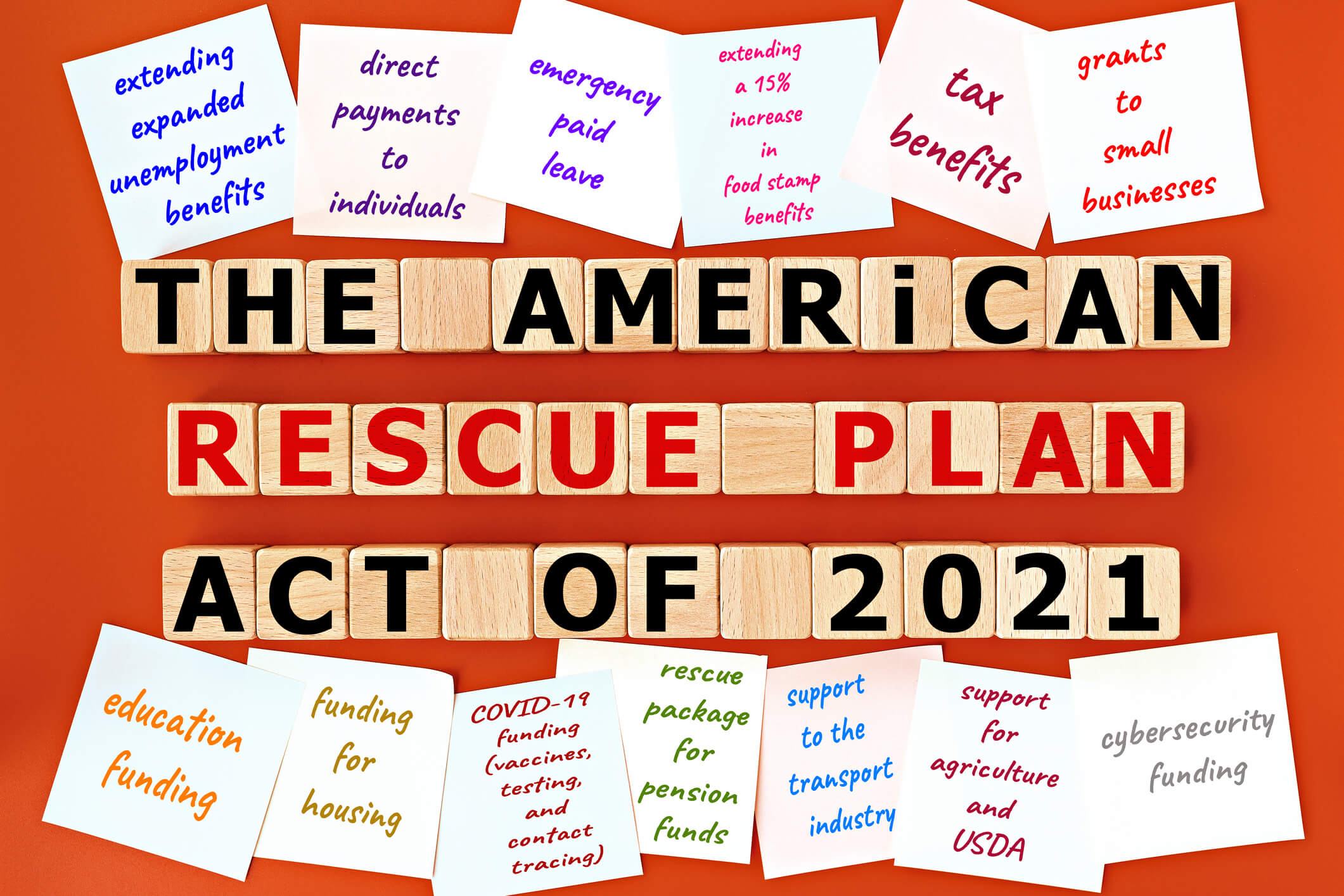

Looking ahead: How the American Rescue Plan affects 2021 taxes. This post is the second of a two-part overview of ways the American Rescue Plan may affect your 2021 taxes. You can read Part 1 on the Blog page of our website. Changes Expanding EITC for 2021 and Beyond New law changes expand the Earned… Read More

Looking ahead: How the American Rescue Plan affects 2021 taxes Part 1 The 2020 tax filing deadline may have just passed, but it is never too early to start planning for filing your 2021 taxes. This post is the first of two that provide an overview of how the American Rescue Plan may affect some… Read More

IRS begins correcting tax returns for unemployment compensation income exclusion. Periodic payments to be made May through summer. The Internal Revenue Service will begin issuing refunds to eligible taxpayers who paid taxes on 2020 unemployment compensation. The recently enacted American Rescue Plan later excluded this compensation from taxable income. American Rescue Plan of 2021 The IRS identified… Read More

IRS suspends the requirement to repay excess advance payments of the 2020 Premium Tax Credit. What Are APTC and PTC The premium tax credit helps pay for health insurance coverage bought from the Health Insurance Marketplace. Those eligible can choose to have all, some, or none of the estimated credit paid in advance directly to their insurance… Read More

American Rescue Plan tax credits available to small employers to provide paid leave to employees receiving COVID-19 vaccines. The American Rescue Plan Act of 2021 (ARP) allows small and midsize employers, and certain governmental employers, to claim refundable tax credits that reimburse them for the cost of providing paid sick and family leave to their… Read More

The third Economic Impact Payment (EIP3) is different from the first and second payments in several ways. The Third Economic Impact Payment Is an Advance Payment of the 2021 Recovery Rebate Credit The two earlier payments are advance payments of the 2020 Recovery Rebate Credit. Eligible people who did not get a first and second Economic Impact Payment… Read More

IRS letters explain why some 2020 Recovery Rebate Credits are different than expected. As people across the country file their 2020 tax returns, some are claiming the 2020 Recovery Rebate Credit (RRC). Some taxpayers who claimed the 2020 credit could be getting a different amount than expected. Should You Claim the Recovery Rebate Credit? It’s important… Read More

IRS warns university students and staff of impersonation email scam. Scam Targets “.edu” Email Addresses The Internal Revenue Service warned of an ongoing IRS-impersonation scam that appears to primarily target educational institutions, including students and staff who have “.edu” email addresses. The IRS’s phishing@irs.gov has received complaints about the impersonation scam in recent weeks from people with… Read More

Update: Tax Filing Deadline Now May 17, 2021 There have been recent changes to the rules for required minimum distributions (RMDs) from retirement accounts. A retirement plan account owner must normally begin taking an RMD annually starting the year he or she reaches 70½ or 72, depending on their birthdate and maybe the year they… Read More